以下是我从 1991 年到 2021 年花了 30 年交易和投资股票市场后学到的 65 个经验教训。

- 趋势可以比我想象的更远更久。

- 最好的交易者在交易中思想开放且灵活。

- 对于大多数交易者来说,少交易胜于多交易,只关注最好的设置和股票。

- 对新股票和市场的潜力持开放态度。

- 价格行为是股市中唯一的真理。

- 永远不要在已经亏损的交易中增加更多资金,即趋势与更大的规模和希望作斗争。

- 除非您知道在哪里设置止损、追踪止损或利润目标,否则切勿进行交易。

- 与市场上的硬性止损相比,我更喜欢日终止损。

- 市场成交量就像是在不同的价格水平上投票。

- 突破通常会重新测试回旧阻力,这将是新的支撑。

- 一个时间停止交易没有任何进展可以释放资金以更好的设置进行交易。

- 最好的交易从一开始就有效。

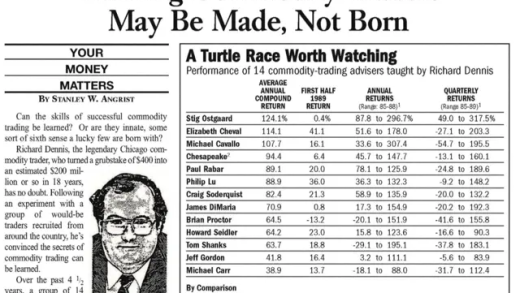

- 一些最好的交易系统很简单,正是交易者的心理创造了最大的优势。

- 您只需要一些技术指标和价格行为即可进行交易,更多指标可能会增加混乱。

- 基本面不等于技术价格行为,情绪和信念推动了大多数价格趋势。

- 经济和股市是两个截然不同的东西。

- 在连续亏损期间交易较小,在连续盈利期间交易较大。

- 当交易者拒绝接受错误的交易时,自我毁灭就开始了。

- 头寸越大,你的情绪就会越响亮。

- 当你证明你的系统是有效的并且你有纪律地遵循它时,自信就会随着时间的推移而出现。

- 专注于一次只做一笔好的交易。

- 打破自己的交易规则可能代价高昂。

- 大多数时候,股票市场的多头头寸是阻力最小的路径。

- 您承认交易错误的速度越快,损失就越小。

- 您必须随时限制头寸的总风险敞口。

- 股票在短期内更像是一场选美比赛,从长远来看更像是一场现金流的较量。

- 移动平均线是我最喜欢的技术指标,因为它们量化了趋势。

- 图表模式的最佳用途是量化动量方向的进场和出场。

- 烛台模式只是让一件事发生在另一件事上的几率更大。

- 很多时候,牛市将由金融板块走高引领。

- 市场不知道你的存在或关心你的意见。

- 意见和预测一文不值。具有优势的系统是无价的。

- 市场有季节性模式,了解它们。

- 股票的高空头兴趣可能是看涨的。

- 如果您希望长期盈利,您必须拥有一个具有优势的量化系统。

- 市场总是在未来而不是现在定价。

- 卖空比在股市做多要困难得多。

- 下降趋势比上升趋势波动更大。

- 波动性会导致很多错误信号,您必须对此进行管理。

- 卖空者必须克服首席执行官、逢低买入者、国会、总统和美联储的努力,以保持股市价格上涨。

- 大多数大动作都始于强烈的动量信号。

- 很多时候,最难进行的交易是正确的交易。

- 其他交易者最好用作如何交易而不是复制他们的交易的例子。

- 最好的交易很难进入。

- 对于新交易者来说,止损比持有亏损交易更难。

- 最好的交易者在市场关闭时进行所有研究,因此在市场开放时进入或退出是自动的。

- 一个好的交易者必须有积极的心态。

- 只有在正确的努力下,努力工作才会在交易中得到回报。

- 交易会教你关于你自己。

- 所有的交易者最终都被贬低了。

- 让交易来找你,不要追逐交易。

- 一个好的交易过程可以帮助你走运。

- 你必须在连败中幸存下来。

- 市场在反转之前通常需要时间来形成顶部或底部。

- 所有股票都经历了积累、分配和区间交易的周期。

- 对交易的信念可能导致大赢或大损失,这对交易者来说是中性的。

- 跟随趋势赚钱,对抗趋势赔钱。

- 您可以根据基本面建立股票观察名单,但您仍然必须在图表上交易价格行为。

- 大多数价格底部都伴随着其他超卖指标和看涨背离的汇合。

- 最大的悲观情绪在市场底部,最大的乐观情绪在市场顶部。

- 交易中的杠杆可以双管齐下,谨慎使用并进行良好的风险管理。

- 大笔资金通常会在一天结束时提示他们的情绪。

- 没有完美的交易,只有良好的入场风险/回报率。

- 永久熊只在下降趋势中赚钱,永久多头只在上升趋势中赚钱,永久猪在任何趋势的错误方向结束时都会炸毁他们的账户。

- 像赌场一样交易,而不是赌徒。

作者:Steve Burns

原文:

Here are 65 lessons I learned after spending thirty years trading and investing in the stock market from 1991-2021.

A trend can go farther and longer than I ever expect.

The best traders are open-minded and flexible in their trades.

For most traders less trades is better than more trades, focus only on the best set ups and stocks.

Be opened minded to the potential of new stocks and markets.

Price action is the only truth in the stock market.

Never add more capital to a trade that is already losing money, that is trend fighting with more size and hope.

Never enter a trade unless you know where you are getting out with a stop loss, trailing stop, or profit target.

I prefer end to day stops over hard set stops in the market.

Volume in the market is like votes being cast at different price levels.

Breakouts usually retest back to old resistance that will be new support.

A time stop out of a trade not going anywhere can free up capital to trade on better setups.

The best trades work right from the start.

Some of the best trading systems are simple, it is the trader’s psychology that creates the biggest edge.

You only need a few technical indicators and price action to trade, more indicators can add confusion.

Fundamentals do not equal technical price action, emotions and beliefs drive most price trends.

The economy and the stock market are two very different things.

Trade smaller during losing streaks and bigger during winning streaks.

Self destruction starts when a trader refuses to accept being wrong about a trade.

The bigger the position size the louder your emotions will be.

Self confidence comes over time as you prove your system is valid and that you are disciplined in following it.

Focus on just making one good trade at a time.

Breaking your own trading rules can be expensive.

Long positions in the stock market are the path of least resistance the majority of the time.

The faster you admit you were wrong about a trade the smaller the loss will be.

You must limit your total risk exposure of positions at any one time.

Stocks are more like a beauty contest in the short term and a cash flow contest in the long run.

Moving averages are my favorite technical indicator because they quantify trends.

A chart patterns best use is to quantify entries and exits in the direction of the momentum.

A candlestick pattern just gives better odds of one thing happening over another.

Many times a bull market will be lead by the financial sector going higher.

The market doesn’t know you exist or care about your opinion.

Opinions and predictions are worth nothing. A system with an edge is priceless.

There are seasonal patterns to the market, understand them.

High short interest on a stock can be bullish.

You must have a quantified system with an edge if you hope to be profitable over the long term.

The market is always pricing in the future not the present.

Short selling is a much more difficult game than going long in the stock market.

Downtrends are much more volatile than uptrends.

Volatility can lead to a lot of false signals, you must manage for this.

Short sellers have to overcome the effort of CEOs, dip buyers, congress, the president, and the Federal Reserve to keep the stock market prices up.

Most big moves start with a strong momentum signal.

Many times, the most difficult trade to take is the right trade.

Other traders are better used as examples on how to trade not copying their trades.

The best trades are many times difficult to enter.

Taking a stop loss is more difficult for new traders than holding a losing trade.

The best traders do all their research when the market is closed so entering or exiting when the market is open is automatic.

A good trader must have a positive mindset.

Hard work is only rewarded in trading when it is the right type of effort.

Trading will teach you about yourself.

All traders are eventually humbled.

Let trades come to you, don’t chase a trade.

A good trading process can help you get lucky.

You must survive losing streaks.

Markets usually take time to make a top or a bottom before reversing.

All stocks go through cycles of accumulation, distribution, and range trading.

Conviction on a trade can lead to big wins or big losses, it is neutral as a benefit to a trader.

Trend following makes money, trend fighting loses money.

You can build a watchlist of stocks based on fundamentals but you still have to trade the price action on the chart.

Most bottoms in price come with a confluence of other oversold indicators and bullish divergences.

Maximum pessimism is at market bottoms, maximum optimism is at market tops.

Leverage in trading can cut both ways, use it with caution and good risk management.

The big money usually tips their hand for their sentiment by the end of the day.

There are no perfect trades only good risk/reward ratios on entry.

Perma bears make money only during downtrends, perma bulls make money only during uptrends, perma pigs blow up their account when they end up on the wrong side of any trend.

Trade like a casino, not a gambler.